2021 SCeJ 948

SUPREME COURT OF INDIA

Before : Ashok Bhushan and R. Subhash Reddy, JJ.

R. JANAKIAMMAL AND S.R. SOMASUNDARAM and another — Appellant

versus

S.K. KUMARASAMY(DECEASED) THROUGH LEGAL REPRESENTATIVES and others — Respondent

Civil Appeal No. 1537 of 2016 with Civil Appeal No.1538 of 2016

30.06.2021

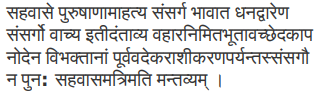

Hindu Joint family – Reunion – To constitute a reunion there must be an intention of the parties to reunite in estate and interest – It is implicit in the concept of a reunion that there shall be an agreement between the parties to reunite in estate with an intention to revert to their former status of members of a joint Hindu family – Such an agreement need not be express, but may be implied from the conduct of the parties alleged to have reunited – But the conduct must be of such an incontrovertible character that an agreement of reunion must be necessarily implied therefrom – As the burden is heavy on a party asserting reunion, ambiguous pieces of conduct equally consistent with a reunion or ordinary joint enjoyment cannot sustain a plea of reunion.

Mayne’s Hindu law, 11th Edn., thus at p. 569:

“As the presumption is in favour of union until a partition is made out, so after a partition the presumption would be against a reunion. To establish it, it is necessary to show, not only that the parties already divided, lived or traded together, but that they did so with the intention of thereby altering their status and of forming a joint estate with all its usual incidents. It requires very cogent evidence to satisfy the burden of establishing that by agreement between them, the divided members of a joint Hindu family have succeeded in so altering their status as to bring themselves within all the rights and obligations that follow from the fresh formation of a joint undivided Hindu family.”

[Para 83]

Cases Referred

- Anil Kumar Mitra and Ors. v. Ganendra Nath Mitra and Ors., (1997) 9 SCC 725

- Attorney-General. Venkataramayya v. Tatayya [AIR 1943 Mad 538]

- Baldbux Ladhuram v. Rukhmabai [(1903) LR 30 IA 190]

- Banwari Lal v. Chando Devi (Smt.) Though LRs. And Anr., (1993) 1 SCC 581

- Bhagwan Dayal v. Reoti Devi, AIR 1962 SC 287

- M/s. Paramanand L. Bajaj, Bangalore v. The Commissioner of Income Tax, Karnataka, II, Bangalore, (1981) SCC Online Karnataka 131

- Mukku Venkataramayya v. Mukku Tatayya and Ors., AIR 1943 Mad. 538

- Palani Ammal v. Muthuvenkatacharla Moniagar and Ors., AIR 1925 PC 49

- Pan Kuer v. Ram Narain Chowdhary, A.I.R. 1929 Pat. 353

- Pushpa Devi Bhagat (Dead) Through LR. Sadhna Rai (Smt.) v. Rajinder Singh and Ors., (2006) 5 SCC 566

- R. Rajanna v. S.R. Venkataswamy and Ors., (2014) 15 SCC 471

- Triloki Nath Singh v. Anirudh Singh (Dead) Through Legal Representatives and Ors., (2020) 6 SCC 629

Mr. Gaurav Agrawal, Advocate, Mr. S. Ravi Shankar, Advocate, Mr. V. Giri, Sr. Advocate and Mr. Vikas Mehta, Advocate, for the Appellant; Ms. Shobha Ramamoorthy, Advocate, Mr. V. Giri, Sr. Advocate, Mr. Vikas Mehta, Advocate, Mrs. Prabha Swami, Advocate, Mr. Nikhil Swami, Advocate, Ms. Divya Swami, Advocate, Mr. S. Nagamuthu, Sr. Advocate, Mr. V.P. Sengottuvel, Advocate, Mr. S. Ravi Shankar, Advocate, Ms. Yamunah Nachiar, Advocate, Mr. R. Nishanth, Advocate, Mr. Akshay Kumar A., Advocate, Mr. K. V. Mohan, Advocate, Mr. Kapil Sibal, Sr. Advocate, Mr. Arunabh Chowdhury, Advocate, Mr. Ankur Chawla, Advocate, Ms. Pallavi Langar, Advocate, Mr. Arun Mohan, Advocate, Mr. Nizam Pasha, Advocate, Mr. R.K. Mohit Gupta, Advocate, Mr. Karthik, Advocate and Mr. Rahul Pratap, Advocate, for Respondent.

JUDGMENT

Ashok Bhushan, J. – These two appeals have been filed challenging the Division Bench judgment dated 23.11.2011 of Madras High Court dismissing the A.S. No.281 of 2000 and A.S. No.332 filed by the appellants respectively. The parties shall be referred to as described in O.S.No.1101 of 1987 (S.R. Somasundaram v. S.K. Kumarasamy). The appellant, R. Janakiammal in C.A.No.1537 of 2016 was defendant No.7 in O.S.No.1101 of 1987 whereas S.R. Somasundaram, appellant in C.A.No.1538 of 2016 was the plaintiff in O.S.No.1101 of 1987. Janakiammal is the mother of Somasundaram. Relevant facts and events necessary to decide these two appeals are:

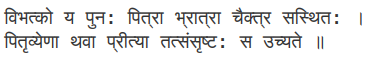

2. The parties came from Pattanam, Coimbatore District, Tamil Nadu. We may notice the Genealogical Tree of the family which is to the following effect:

3. The plaintiff, S.R. Somasundaram and his mother, Janakiammal who are the appellants in these two appeals belong to branch of Rangasamy Gounder whereas other two branches are of S.K. Kumarasamy,D-1 and S.K. Chinnasamy,D-4. Three brothers with their father A.V. Kandasamy Gounder were residing as a joint family in ancestral house at Sadapalayam Hemlet, Karumathampatti Village, Palladam Taluka, District Coimbatore. Rangasamy and others received a land measuring 86.72 acres by partition deed executed on 27.09.1953 between late A.V. Kandasamy Gounder and Ponnammal, junior wife of Kandasamy Gounder, his first wife, Senniamalai, son of Kandasamy Gounder from first wife, Rangasamy Gounder, S.K. Kumarasamy, S.K. Chinnasamy, all sons of second wife of Kandasamy.

4. These appeals are concerned with three branches, namely, Rangasamy, Kumarasamy and Chinnasamy. In the year 1954-55, three brothers purchased various properties and started rice mill business called Laxmi Rice Mills and also started Swamy Textiles in 1976, a match factory, aslate factory, saw mills, timber business and power loom out of joint family funds. On 07.11.1960 a partition deed was registered between three brothers with respect to the properties allotted to them as per registered partition deed dated 27.09.1953 along with the properties purchased by three brothers in the ratio of 1/3rd each. Even after partition, three brothers continued to live under the same roof and carried on business as partners. In the year 1963 they purchased housing site by sale deed dated 16.10.1963 in Somanur Hemlet, Village Karumathampatti, and constructed a house therein and all the three brothers started living in Somanur house from the year 1964 and carried on their different joint business. On 27.05.1967, Rangasamy Gounder died in a road accident leaving behind his widow, Janakiammal, two sons, S.R. Somasundaram, S.R. Shanmugavelayutham and one daughter, S.Saraswathy. From 1968 to 1978 various properties were purchased in the name of three branches. The family also purchased in the year 1972 Tea Estate known as High Field Estate in the name of defendant Nos.1, 4, 10 and plaintiff. A Private Limited Company known as Swamy andSwamy Plantations (P) Ltd. was also promoted with family members being shareholders and Directors.

5. In the year 1975, 50 acres of lands were purchased in Vedapatti village, in the name of defendant Nos.1, 4, 10 and plaintiff. In the year 1978 a palatial Bungalow was purchased in Tatabad, Coimbatore. Defendant No.10, who was Captain in the Indian Army, came back to Coimbatore after leaving his job to look after the family business and properties. From the year 1973, he started looking after the properties at Coonoor. Somasundaram, the plaintiff started his studies at Coimbatore and Chennai and after completing his studies came back to Coimbatore in the year 1979.

6. In Coimbatore one Vasudeva Industries Ltd., which was in liquidation since 1967 was taken on lease from official liquidator of Madras High Court by one Shroff, who along with defendant No.4, S.K. Chinnasamy formed a partnership firm to run Vasudeva Industries Ltd. Defendant No.1, S.K. Kumarasamy was appointed as General Manager to look after the affairs of Vasudeva Industries Limited. An application was filed in the year 1981 inCompany Petition No.39 of 1956. Defendant No.1, S.K. Kumarasamy filed an affidavit in support of Company Application No.320 of 1981 praying that liquidation proceedings be closed. On 30.04.1981, the High Court of Madras passed order directing convening of a meeting of the creditors. In the meeting of creditors a draft scheme submitted was approved on 09.06.1981, Madras High Court passed an order on 22.01.1982 allowed the application filed by defendant No.1, permanently stayed the liquidation proceedings and permitted running of Vasudeva Industries Ltd. by the Board of Directors. On 03.02.1982 a Resolution was passed to bring the mills under the control of the Board of Directors, including the plaintiff, defendant Nos.1, 4 and 10. The name of Vasudeva Industries Ltd. was changed to Vasudeva Textiles Mills. In the year 1983 Vasudeva Textiles Mills( hereinafter referred to as “Mills”) obtained loan from Punjab National Bank in which personal guarantee was also given by the plaintiff and defendant No.10, who were Directors. The plaintiff and defendant No.10 were also in the year 1984 elected as Managing Directors. The Swamy & Swamy Co. which was earlier running the Mill on lease was dissolved in the year 1984. The Mills although started running by the Board of Directors but in the years 1983, 1984 and 1985 accumulated losses were more than the profit of Mills.

7. On 19.01.1984, C. Senthil Kumaravel, defendant No.6 and son of S.K. Chinnasami, defendant No. 4 filed O.S. No.37 of 1984 praying, inter alia, for partition and allotment of 1/6th share to him. In O.S.No. 37 of 1984 Senthil Kumaravel, the plaintiff came with the case that the plaintiff and defendant Nos.1, 3,4, 8,9 and 10 were members of joint family. In O.S.No.37 of 1984, Janakiammal was impleaded as defendant No. 8, Shanmugavelayutham as defendant No.9, Somasundaram as defendant No.10 and Saraswathi as defendant No.11. In the plaint case, it was stated that even after registered partition deed dated 07.11.1960 between three branches, defendant Nos.1, 4 and the deceased K. Rangasami continued to live jointly and did business jointly. All the three branches lived jointly. In the plaint, it was further stated that from the savings of the income and by mortgaging ancestral property, the capital necessary for the business was found and the business was expanded from time to time. It was further pleaded that plaintiff, Senthil Kumaravel was entitled to 1/6th share. Defendant Nos.8 to 11, representing the branch of deceased K. Rangasami, were entitled jointly 1/3rd share in all suit properties. The plaintiff in suit had prayed following reliefs:

“a) to divide the immovable suit properties described in the schedules ‘B’, ‘D’ and ‘E’ and items 1 to 9 in Schedule ’C hereunder into six equal shares by metes and bounds with reference to good and bad soil and allot one such share to him with separate possession;

b) to allot 1/6th share in the shares mentioned in item 10 and 11 of Schedule ‘C’ and item 2 of Schedule ‘D’ described hereunder;

c) directing the defendants to pay cost of the suit;”

8. The plaint Schedule ‘B’ included ancestral land in Palladam and Samalapuram villages with house at Sadapalayam Helmet. Schedule ‘C’ included various immovable properties and included residential building,shares in M/s. Swamy and Swamy Plantations (P) Ltd. Coonoor, and shares of M/s. Vasudeva Industries Ltd. were also mentioned as item Nos. 10 and 11 of Scheduled ‘C’. In the above suit only defendant Nos.1 to 3 of the suit, namely, S.K. Kumarasamy, Sundarambal, wife of S.K. Kumarasamy and minor Kandavadivel son of S.K. Kumarasamy filed their written statements. In the written statement, it was pleaded that no doubt some properties have been acquired jointly in the names of the defendant Nos.1, 3, 4,9 and 10, but they must be deemed to be only co-sharers in respect of those properties. It was pleaded that three branches were allotted shares in 1960 partition and plaint case that parties continued to live jointly was denied.

9. In O.S.No.37 of 1984, an application under Order XXIII Rule 3 was filed on 06.08.1984 by the plaintiff containing signatures of plaintiff and defendants. In the application under Order XXIII Rule 3 in Schedule ‘A’ to Schedule ‘J’, various items of properties were listed and allocated to different members of the family. On the basis of application under Order XXIII Rule 3, Sub-ordinate Judge, Coimbatore passed an order dated 6.8.1984 and directed for preparation of decree on the basis of compromise petition.

10. In the compromise decree although various agricultural properties, house properties and shares were allotted to two other branches, i.e., branches of S.K. Kumarasamy and S.K. Chinnasamy but the branch of Rangasamy was allocated only shares in Vasudeva Industries which was under liquidation and taken under the orders of Madras High Court dated 21.01.1982 to be run by the Board of Directors.

11. Minor children of defendant No.10 filed O.S.No. 827 of 1987 through their mother challenging the compromise decree dated 06.08.1984 on the ground that they were not parties thereto. On 03.08.1987 O.S. No.1101 of 1987 was filed by both the sons of Rangasamy, i.e., S.R. Shanmugnavelayutham and S.R. Somasundaram. In O.S. No.1101 of 1987 defendant Nos.1,2 and 3 filed their written statements where it was pleaded that there was agreement on 08.03.1981 between the three branches where defendant No.1 was to pay Rs. 4 lacs to defendant No. 4and plaintiff was to pay Rs. 7 lacs to defendant No.4 and since payment was not made to defendant No. 4 suit was filed through his son. It was further pleaded that compromise dated 06.08.1984 was to give effect to earlier agreement dated 08.03.1981. In the O.S. No.827 of 1987, an affidavit was filed by the mother of the minor stating that they had entered into the compromise with defendant No.1 hence seeking permission to withdraw the suit. On 10.02.1993, the O.S. No.827 of 1987 was withdrawn, on the same date Shanmugavelayuthem who was the first plaintiff in O.S.No.1101 of 1987 withdrew himself from the suit and was transposed as defendant No.10 in the suit. The written statement was filed by Janakiammal, defendant No.8 supporting the plaintiff’s case and also praying for partition of her share. Senthil Kumaravel, who was plaintiff in Suit No.37 of 1984, filed a written statement in O.S.No.1101 of 1987 where he stated that he filed Suit No.37 of 1984 at the instance of S.K. Kumarasamy, defendant No.1 and decree dated 06.08.1984 was sham and nominal, and was not to be given effect to. Additional written statements were filed by defendantNos.1 to 3. Defendant No.10 also filed written statement supporting the case of defendant No.1. Reply was filed by plaintiff, Somasundaram to the written statements filed by defendant Nos. 1 to 3.

12. Five witnesses were examined on behalf of the plaintiff. Somasundaram, plaintiff appeared as PW.1. The plaintiff filed Exhs. A-1 to A-55. On the side of defendants, four witnesses were examined. Janakiammal appeared as DW.2 whereas S.K. Kumarasamy appeared as DW.1. Exh.B-1 to B-104 were marked on behalf of the defendants. Exh. X-I to X-2 7 have been marked through witnesses.

13. The trial court framed five issues and six additional issues. One of the additional issues was that whether the suit is not maintainable under Order XXIII Rule 3A of the CPC. The trial court vide its judgment dated 30.09.1997 dismissed the suit. The trial court upheld the plea of defendant Nos.1 to 3 that O.S.No.1101 of 1987 was barred by Order XXIII Rule 3A CPC. The trial court also upheld the partition deed dated 07.11.1960 and the agreement dated 08.03.1981. The trial court held that after the year 1960 the entire family was not living as joint family and all the three branches are co-owners as far as properties are concerned and were running partnership businesses. Challenging the judgment of the trial court dismissing the suit two appeals were filed in the High Court. A.S.No.332 of 1999 was filed by Somasundaram, the plaintiff and A.S. No. 281 of 2000 was filed by Janakiammal defendant No.8.

14. The High Court has noticed the point for determination in the appeal, i.e., whether O.S.No.1101 of 1987 is maintainable in the light of the provisions contained in Order XXIII Rule 3A of the CPC. The High Court, however, observed that appeals could be disposed of according to the finding to be recorded on the aforesaid point for consideration, however, it has not formulated any other point for consideration though extensive arguments have been made by the respective counsel. It is useful to reproduce paragraphs 163 and 164 of the judgment of the High Court, which are to the following effect:

“163. The point for determination that arises for consideration in the above appeals is as to whether the suit seeking to declare the decree passed in O.S.No.37 of 1984 on the file of the Sub Court, Coimbatore, is sham and nominal, ultra-vires, collusive, unsustainable, invalid, unenforceable and not binding on the plaintiff, is maintainable in the light of the provisions contained in Order 2 3 Rule 3 of the CPC and Order 23 Rule 3-A of the CPC?

164. As the appeals could be disposed of on the basis of the finding to be recorded on the aforesaid point for determination, we have not formulated any other point for determination, though extensive arguments have been made by the respective counsel as to whether the partition effected under Ex.B-2 6, dated 07.11.1960 between Rangaswamy (father of the plaintiff), Kumaraswamy (D-1) and Chinnaswamy (D-4) was acted upon or not; whether there was a joint family among the three branches after 07.11.1960; whether the various businesses run under different partnership firms are the joint family businesses.”

15. The High Court after considering the submissions of the respective counsel came to the conclusion that compromise decree dated 06.08.1984 in Suit No.37 of 1984 was valid, the plaintiff failed to prove that any fraud was played. The plaintiff, further, failed to prove that they gave any guarantee in the year 1984 for taking loan from Punjab National Bank. Hence, basis of the suit that they signed the compromise deed on the representation of defendant No.1 and that the plaintiff and defendant having given personal guarantee for loan obtained for Vasudeva Industries Ltd., to save family properties from claim of the Bank, the properties be kept only in the name of defendant No.1 and defendant No. 4 but the right of the plaintiff and defendants will be held intact.

16. The High Court held that it has not been proved that any personal guarantee was given by the plaintiff, the very ground pleaded by the plaintiff is knocked out. The High Court further held that suit was barred by Order XXIII Rule 3A CPC and only remedy available was to question the compromise decree in the same suit. The High Court dismissed both the appeals. Aggrieved by the judgment of the High Court, these two appeals have been filed.

17. We have heard Shri V. Giri and Shri Gaurav Agrawal, learned senior counsel for the appellants. Shri Kapil Sibal, learned senior counsel has appeared for contesting respondents. Shri S. Nagamuthu, learned senior counsel has appeared for defendant No.11 and other defendants.

18. Shri V.Giri, learned senior counsel appearing for R. Janakiammal submits that the compromise decree dated 06.08.1984 in Suit No.37 of 1984 is unfair, inequitable and fraudulent. Shri Giri submits that Janakiammal who was defendant No.8 in Suit No.37 of 1984 was not aware of the compromise application or its terms. Janakiammal is a widow only knowing Tamil, she signed the English written papers which was brought to her by DW-2, wife of D-1. She never engaged any counsel. Shri P.R. Thirumalnesan, learned counsel, was never engaged by her. She never went into the Court nor appeared before the Court on 06.08.1984. The family possessed several hundreds acres of land, several houses and other numerous assets but in the compromise decree, she was allotted 200 shares which were in the name of Smt. Kamalam, DW-2 of a sick mill, i.e., Vasudev Mill.

19. The properties which she inherited from her late husband Rangasamy and numerous properties which were purchased in her name after the death of her husband were all allocated to branches of D-1 and D-4 without giving an inch of land to her. The shares were also allotted to D-2 and D-5, the wives of D-1 and D-4, who have no pre existing rights. Janakiammal and her son Somasundaram did not get any immovable property in the compromise decree except shares of the Vasudeva mills, a sick company. The consent decree clearly records that no Vakalatnama has been filed by D-8. When no Vakalatnama was filed by D-8, she was not represented by a counsel and the Court was misled to believe that Thirumalnesan, advocate represented D-8.

20. The learned counsel submits that the family of three brothers lived jointly and continued to be joint family even after partition dated 07.11.1960 and acquired several properties in the name of three branches. The family possessed more than 260 acres of land at different places with several houses but no immovable property was allocated to Janakiammal or her sons.

21. O.S. No.37 of 1984 was filed on the behest of S.K. Kumarasamy by C. SenthilKumaravel, son of S.K.Chinnasamy.C. Senthil Kumaravel in his written statement in Suit No.1101 of 1987 has pleaded that Suit No. 37 of 1984 was filed by him at the behest of S .K.Kumar as amy, D-1. C. Senthilkumaravel further pleaded that decree in O.S. No. 37 of 1984 was sham and nominal. The 200 shares allotted to Janakiammal as per compromise decree dated 06.08.1984 which were in the name of Smt. Kamalam were never transferred to Janakaiammal. Janakiammal fully supported the plaint case of suit No.1101 of 1987.

22. The partition agreement dated 08.03.1981 as pleaded by D-1 was only an imaginary story. No such agreement was filed in the court nor the same was pleaded in a written statement filed by D.1-3 in O.S. No.37 of 1984. Despite the agreement dated 08.03.1981 not being produced in the Court, the trial court in its judgment dated 30.09.1997 had erroneously accepted the factum of partition by agreement dated 08.03.1981 and accepted the case of defendant No.1 that compromise decree dated 06.08.1984 was to give effect to the partition dated 08.03.1981.

23. No partition was affected in the year 1981 and the family remained as a joint family. In O.S. No.37 of 1984, the house property at Tatabad which was in the name of D-1, was not included, which property was purchased by joint family fund and the three branches had share in house at Tatabad which was mentioned at item No. 10 in Schedule C of Suit No.1101 of 1987.

24. The pleading of defendant No.1 that under the agreement dated 08.03.1981, the plaintiff was to pay Rs. Seven Lakhs to D-4 and D-1 was to pay Rs. Four Lakhs to D-4 were all imaginary stories set up by D-1. Neither any agreement took place on 08.03.1981 nor any amount was to be paid by plaintiff to D-4. The house at Tatabad purchased in the year 1978 with the joint family fund was not included in O.S. No.37 of 1984, and in the house all members of the family had a share. The amount of Rs.1,03,000/-, which was received by Janakiammal from the Insurance Corporation after the death of her husband was given to defendant No.1, which was utilised for business purposes. The High Court did not consider the case of Janakiammal as pleaded.

25. Shri Gaurav Agrawal, learned counsel appearing in Civil Appeal No. 1538 of 2016 on behalf of Somasundaram submits that plaintiff was deprived of his immovable properties including land and houses and was given only worthless shares in the Compromise decree dated 06.08.1984. He submits that the suit No.1101 of 1987 was filed by the plaintiff to declare the decree dated 06.08.1984 void, unenforceable and fraudulent.

26. It is submitted that the plaintiff was taken to the Court by D-1 on 06.08.1984 and was asked to sign the compromise application on the representation that since the plaintiff and D-10 had given personal guarantee for the loan taken for Vasudeva Textiles Mills from Punjab National Bank, their name should not be any immovable property to save the family property. The plaintiff was assured by D-1 that his right in immovable property shall not be affected by the Compromise decree as the decree dated 06.08.1984 shall not be made effective.

27. It is submitted that the allocation of the properties in the compromise decree is unfair. A fraud was played on the plaintiff as well as on the court in obtaining the compromise decree. It is submitted that the Order XXIII Rule 3A shall not govern a case where a fraud is played on the Court. Suit No. 37 of 1984 was filed on illusory cause of action, bar under Order XXIII Rule 3A shall not apply. The High Court after having found that suit is barred under Order XXIII Rule 3A has not entered into other issues. The house property of Tatabad which was purchased in 1978 was not included in Schedule of O.S.NO.37 of 1984 which property was included in Suit No.1101 of 1987, hence, suit for share in house property at Tatabad was fully maintainable. The plaintiff has completed his graduation in Textile Engineering. Vasudeva Industries was not a family concern, which was under litigation and was not a profit making venture. The consent decree dated 06.08.1984 was never acted upon. The mill could not be revived and closed down in 1987. The defendant No.1 continued to manage the affairs of the mill till 1989 when he resigned.

28. Shri Kapil Sibal refuting the submissions of the appellants contends that partition dated 07.11.1960 between three branches was given effect to. Income Tax Returns were filed by three branches on the basis of 1960 partition. There was an arrangement made in 1981 under which the D-1 was to take properties at Coonoor, D-4 was to take properties at Somnur whereas plaintiff and defendant No.1 decided to take Vasudeva Textiles Mills. The Suit No.37 of 1984 was filed by the son of D-4 at his instance.

29. Shri Sibal submits that the Suit No. 37 of 1984 has been decided on compromise where all the defendants have signed the compromise application including Janakiammal as well as Somasundaram. The Vakalatnama on behalf of defendant Nos.7 to 11 was filed by Advocate Thirumalnesan who represented defendants 8 to 11. It is submitted that plaintiff and D-10 were all educated persons and having signed the compromise application, it is not open to them to contend that they signed the application under some misrepresentation or fraud.

30. The plaintiff and defendant No.10 wanted to take the mill in their share hence, the shares of the mill were allocated in the compromise decree to Rangasamy Branch. Rangasamy Branch had 95% shares in the Mill, i.e., the controlling share. The mill was valued at the rate of Rs.32 Lakhs. There is no fraud in the compromise decree. The Compromise decree dated 06.08.1984 was given effect to. There being partition in the year 1960 there was neither any joint family property nor any joint family. It was pleaded by the plaintiff that his mother and sister expressed a desire not to take any share. In 1989, the plaintiff had sold the Vasudeva Mills.

31. Shri Sibal submits that none of the pleadings of the plaintiff falls in the definition of fraud. No fraud was committed on the plaintiff. Under Order XXIII Rule 3A CPC, no separate suit could have been filed to question the compromise decree.

32. Shri Sibal submits that the remedy open for the plaintiff was to either file an application in suit No.37of 1984 or file an appeal against the Compromise decree. Filing of suit No. 1101 of 1987 is nothing but litigative gambling by the plaintiff. Shri Sibal submits that the suit filed by the plaintiff deserves to be dismissed with costs.

33. Shri Nagamuthu, learned senior counsel appearing for the defendant No.11 has supported the judgment of the Courts below. He submits that from 1989, selling of shares of the mill started. The defendant No.1 purchased the shares of the mill. The Compromise decree dated 06.08.1984 was acted upon. In 1994, the complete shares of the mill were transferred. Shri Nagamuthu submits that the defendant No.11 and other defendants were transferee of the shares.

34. Shri Giri in rejoinder submission submits that Janakiammal’s case was that she never engaged any advocate. She, however, stated that she had signed the compromise application in Tamil. Her case was that she does not know English and the Compromise was written in English. Signatures of Janakiammal were taken on compromise application by D-2, wife of D-1, who in usual course, for the purposes of business and Tax obtains signatures of Janakiammal from time to time. The family was running various businesses. Shri Giri submits that the judgment of the trial court dated 06.08.1984 in O.S. No.37 of 1984 states that Vakalatnama of defendant Nos.8 to 13 was not filed. He submits that certified copy of Vakalatnama filed by advocate Thirumalnesan on behalf of defendant Nos.8 to 13 has also not been brought on record and according to the papers submitted by D-1, the Vakalatnama and the documents have been destroyed. How can D-1 say that the Vakalatnama has been destroyed.

35. Shri Giri submits that the house at Tatabad which was included as Item No. 10 in Schedule C in Suit No. 1101 of 1987 was purchased from a joint family fund. Although the house was taken in auction by D-1 but the consideration for house was not paid by D-1 individually, rather the amount was obtained from company Swamy and Swamy Plantations, which is a private limited company in whichD-1, D-4 and D-10 had shares. The Branch of Rangasamy in Swamy and Swamy Plantations had about more than one-third share. The Tatabad house having been obtained from a private company which was a family business, all the branches shall have shares in the house. The Suit No. 37 of 1984 having not included the Tatabad house, the suit for partition of house being Suit No. 1101 of 1987 was fully maintainable and both the Courts erred in not granting share to the plaintiff in the said house.

36. One of the additional issues, which were framed by the trial court, was “Whether the suit is not maintainable in view of Order 2 3 Rule 3 (A) of the Code of Civil Procedure?”

37. The trial court has decided the above issue against the plaintiff holding that separate suit challenging the compromise decree is barred as per Order XXIII Rule 3A of Civil Procedure Code.

38. The High Court in the impugned judgment as noted above has observed that the appeals can be decided on only one point of consideration, i.e., as to whether Suit No. 1101 of 1997 filed by the plaintiff Somasundaram challenging the compromise decree dated 06.08.1984 was barred under Order XXIII Rule 3A. The High Court in the impugned judgment relying on judgments of this Court held that no separate suit is maintainable questioning the compromise decree, hence Suit No.1101 of 1987 was barred. Both the Courts having held that Suit No. 1101 of 1987 filed by the plaintiff is barred under Order XXIII Rule 3A, we deem it appropriate to first consider the above issue.

39. Order XXIII Rule 3 provides for compromise of suit. In Rule 3 amendments were made by Act No. 104 of 1976 by which a proviso and an explanation was added. Order XXIII Rule 3 as amended is to the following effect:-

“3. Compromise of suit. – Where it is proved to the satisfaction of the Court that a suit has been adjusted wholly or in part by any lawful agreement or compromise in writing and signed by the parties, or where the defendant satisfies the plaintiff in respect of the whole or any part of the subject-matter of the suit, the Court shall order such agreement, compromise or satisfaction to be recorded, and shall pass a decree is accordance therewith so far as it relates to the parties to the suit, whether or not the subject-matter of the agreement, compromise or satisfaction is the same as the subject-matter of the suit:

Provided that where it is alleged by one party and denied by the other that an adjustment or satisfaction has been arrived at, the Court shall decide the question; but no adjournment shall be granted for the purpose of deciding the question, unless the Court, for reasons to be recorded, thinks fit to grant such adjournment.

Explanation-An agreement or compromise which is void or voidable under the Indian Contract Act, 1872 (9 of 1872), shall not be deemed to be lawful within the meaning of this rule;”

40. By the same amendment Act No.104 of 1976, a new Rule, i.e., Rule 3A was added providing

“3A. Bar to suit. – No suit shall lie to set aside a decree on the ground that the compromise on which the decree is based was not lawful.”

41. Determination of disputes between persons and bodies is regulated by law. The legislative policy of all legislatures is to provide a mechanism for determination of dispute so that dispute may come to an end and peace in society be restored. Legislative policy also aims for giving finality of the litigation, simultaneously providing higher forum of appeal/revision to vend the grievances of an aggrieved party. Rule 3A which has been added by above amendment provides that no suit shall lie to set aside a decree on the ground that the compromise on which the decree is based was not lawful. At the same time, by adding the proviso in Rule 3, it is provided that when there is a dispute as to whether an adjustment or satisfaction has been arrived at, the same shall be decided by the Court which recorded the compromise. Rule 3 of Order XXIII provided that where it is proved to the satisfaction of the Court that a suit has been adjusted wholly or in part by any lawful agreement or compromise, the Court shall order such agreement or compromise to be recorded and pass a decree in accordance therewith. Rule 3 uses the expression “lawful agreement or compromise”. The explanation added by amendment provided that an agreement or a compromise which is void or voidable under the Indian Contract Act, 1872, shall not be deemed to be lawful.”

42. Reading Rule 3 with Proviso and Explanation, it is clear that an agreement or compromise, which is void or voidable, cannot be recorded by the Courts and even if it is recorded the Court on challenge of such recording can decide the question. The Explanation refers to Indian Contract Act. The Indian Contract Act provides as to which contracts are void or voidable. Section 10 of the Indian Contract Act provides that all agreements are contracts if they are made by the free consent of parties competent to contract, for a lawful consideration and with a lawful object, and are not hereby expressly declared to be void. Section 14 defines free consent in following words:-

“14. ”Free consent” defined.-Consent is said to be free when it is not caused by-

(1) coercion, as defined in section 15, or

(2) undue influence, as defined in section 16, or

(3) fraud, as defined in section 17, or

(4) misrepresentation, as defined in section 18, or

(5) mistake, subject to the provisions of sections 20, 21 and 22.

Consent is said to be so caused when it would not have been given but for the existence of such coercion, undue influence, fraud, misrepresentation or mistake.”

43. A consent when it is caused due to coercion, undue influence, fraud, misrepresentation or mistake is not free consent and such agreement shall not be contract if free consent is wanting. Sections 15, 16, 17 and 18 define coercion, undue influence, fraud and misrepresentation. Section 19 deals with voidability of agreements without free consent. Section 19 is to the following effect:-

“19. Voidability of agreements without free consent.-When consent to an agreement is caused by coercion, fraud or misrepresentation, the agreement is a contract voidable at the option of the party whose consent was so caused.

A party to a contract whose consent was caused by fraud or misrepresentation, may, if he thinks fit, insist that the contract shall be performed, and that he shall be put in the position in which he would have been if the representations made had been true.

Exception.-If such consent was caused by misrepresentation or by silence, fraudulent within the meaning of section 17, the contract, nevertheless, is not voidable, if the party whose consent was so caused had the means of discovering the truth with ordinary diligence.

Explanation.-A fraud or misrepresentation which did not cause the consent to a contract of the party on whom such fraud was practised, or to whom such misrepresentation was made, does not render a contract voidable.”

44. A conjoint reading of Sections 10, 13 and 14 indicates that when consent is obtained by coercion, undue influence, fraud, misrepresentation or mistake, such consent is not free consent and the contract becomes voidable at the option of the party whose consent was caused due to coercion, fraud or misrepresentation. An agreement, which is void or voidable under the Indian Contract Act, shall not be deemed to be lawful as is provided by Explanation to Rule 3 of Order XXIII.

45. We need to examine the grounds on which the compromise decree dated 06.08.1984 was sought to be impeached by pleadings in Suit No. 1101 of 1987. Whether the grounds to impeach the compromise deed are one which can be raised before the Court recording the compromise decree as per Rule 3 of Order XXIII? We need to look into the grounds on the basis of which Suit No. 1101 of 1987 was filed questioning the compromise decree. Paragraphs 12 and 13 of the plaint contain the allegations, which are to the following effect:-

“12. In the beginning of 1984, the 1stdefendant represented that since the plaintiff have given personal guarantee to the Bank for the loans of several lakhs, it would be risky and not expedient to have the family properties in the name of the plaintiff and it would be advantageous and safe to keep off the names of the plaintiff on records as owners. Even there the plaintiff did not direction and wisdom of the 1st defendant. The 1st defendant further represented that the entire family properties would be kept in the name of defendants- 1 and 4 for the purpose of record and to avoid the risk of any bank claim. The 1st defendant assured that this arrangement would not affect or extinguish the plaintiff legitimate share in the properties. Here again the plaintiff obeyed and acted according to the decision and directions of the 1st defendant.

13. The 1st defendant arranged to file a suit in Sub Court, Coimbatore, through the family lawyer. It was a collusive suit and a mere make believe affairs. There was no misunderstanding or provocations for any one of the members of the family to go to a Court of Law for partition.”

46. In paragraph 15 of the plaint, the plaintiffs had further pleaded that entire proceedings and the decree secured from the Court is a fraud played not only on the plaintiff but also against the Court. The plaintiffs pleads that compromise decree which was intended only to secure and safeguard the properties is sham and nominal besides being fraudulent.

47. From the above, it is clear that plaintiff pleaded that compromise recorded on 06.08.1984 was not lawful compromise having been obtained by fraud and misrepresentation. The plaintiff’s case was that they were represented by D1 that the compromise is being entered only to save the family property since the plaintiff has given personal guarantee to the Punjab National Bank for obtaining loan for Vasudeva Mills. Pleadings clearly make out the case of the plaintiff that the consent which he gave for compromise by signing the compromise was not free consent. The compromise, thus, become voidable at the instance of the plaintiff.

48. Whether the bar under Rule 3A of Order XXIII shall be attracted in the facts of the present case as held by the Courts below is the question to be answered by us. Rule 3A bars the suit to set aside the decree on the ground that compromise on which decree was passed was not lawful. As noted above, the word “lawful” has been used in Rule 3 and in the Explanation of Rule 3 states that “an agreement or compromise which is void or voidable under the Indian Contract Act,1872 (9 of 1872), shall not be deemed to be lawful……………….;”

49. Thus, an agreement or compromise which is clearly void or voidable shall not be deemed to be lawful and the bar under Rule 3A shall be attracted if compromise on the basis of which decree was passed was void or voidable.

50. Order XXIII Rule 3 as well as Rule 3A came for consideration before this Court in large number of cases and we need to refer to few of them to find out the ratio of judgments of this Court in context of Rule 3 and Rule 3A. In Banwari Lal v. Chando Devi (Smt.) Though LRs. And Anr., (1993) 1 SCC 581, this Court considered Rule 3 as well as Rule 3A of Order XXIII. This Court held that object of the Amendment Act, 1976 is to compel the party challenging the compromise to question the Court which has recorded the compromise. In paragraphs 6 and 7, following was laid down:-

“6. The experience of the courts has been that on many occasions parties having filed petitions of compromise on basis of which decrees are prepared, later for one reason or other challenge the validity of such compromise. For setting aside such decrees suits used to be filed which dragged on for years including appeals to different courts. Keeping in view the predicament of the courts and the public, several amendments have been introduced in Order 2 3 of the Code which contain provisions relating to withdrawal and adjustment of suit by Civil Procedure Code (Amendment) Act, 1976. Rule 1 of Order 23 of the Code prescribes that at any time after the institution of the suit, the plaintiff may abandon his suit or abandon a part of his claim. Rule 1(3) provides that where the Court is satisfied (a) that a suit must fail by reason of some formal defect, or (b) that there are sufficient grounds for allowing the plaintiff to institute a fresh suit for the subject-matter of a suit or part of a claim, it may, on such terms as it thinks fit, grant the plaintiff permission to withdraw such suit with liberty to institute a fresh suit. In view of Rule 1(4) if plaintiff abandons his suit or withdraws such suit without permission referred to above, he shall be precluded from instituting any such suit in respect of such subject-matter. Rule 3 of Order 2 3 which contained the procedure regarding compromise of the suit was also amended to curtail vexatious and tiring litigation while challenging a compromise decree. Not only in Rule 3 some special requirements were introduced before a compromise is recorded by the court including that the lawful agreement or a compromise must be in writing and signed by the parties, a proviso with an explanation was also added which is as follows:

“Provided that where it is alleged by one party and denied by the other that an adjustment or satisfaction has been arrived at, the Court shall decide the question; but no adjournment shall be granted for the purpose of deciding the question, unless the Court, for reasons to be recorded, thinks fit to grant such adjournment.

Explanation.- An agreement or compromise which is void or voidable under the Indian Contract Act, 1872 (9 of 1872), shall not be deemed to be lawful within the meaning of this rule.”

7. By adding the proviso along with an explanation the purpose and the object of the amending Act appears to be to compel the party challenging the compromise to question the same before the court which had recorded the compromise in question. That court was enjoined to decide the controversy whether the parties have arrived at an adjustment in a lawful manner. The explanation made it clear that an agreement or a compromise which is void or voidable under the Indian Contract Act shall not be deemed to be lawful within the meaning of the said rule. Having introduced the proviso along with the explanation in Rule 3 in order to avoid multiplicity of suit and prolonged litigation, a specific bar was prescribed by Rule 3-A in respect of institution of a separate suit for setting aside a decree on basis of a compromise saying:

“3-A. Bar to suit.- No suit shall lie to set aside a decree on the ground that the compromise on which the decree is based was not lawful.”

51. The next judgment to be noted is Pushpa Devi Bhagat (Dead) Through LR. Sadhna Rai (Smt.) v. Rajinder Singh and Ors., (2006) 5 SCC 566, Justice R.V. Raveendran speaking for the Court noted the provisions of Order XXIII Rule 3 and Rule 3A and recorded his conclusions in paragraph 17 in following words:-

“17. The position that emerges from the amended provisions of Order 2 3 can be summed up thus:

(i) No appeal is maintainable against a consent decree having regard to the specific bar contained in Section 96(3) CPC.

(ii) No appeal is maintainable against the order of the court recording the compromise (or refusing to record a compromise) in view of the deletion of clause (m) of Rule 1 Order 43.

(iii) No independent suit can be filed for setting aside a compromise decree on the ground that the compromise was not lawful in view of the bar contained in Rule 3-A.

(iv) A consent decree operates as an estoppel and is valid and binding unless it is set aside by the court which passed the consent decree, by an order on an application under the proviso to Rule 3 Order 23.

Therefore, the only remedy available to a party to a consent decree to avoid such consent decree, is to approach the court which recorded the compromise and made a decree in terms of it, and establish that there was no compromise. In that event, the court which recorded the compromise will itself consider and decide the question as to whether there was a valid compromise or not. This is so because a consent decree is nothing but contract between parties superimposed with the seal of approval of the court. The validity of a consent decree depends wholly on the validity of the agreement or compromise on which it is made. The second defendant, who challenged the consent compromise decree was fully aware of this position as she filed an application for setting aside the consent decree on 21-8-2001 by alleging that there was no valid compromise in accordance with law. Significantly, none of the other defendants challenged the consent decree. For reasons best known to herself, the second defendant within a few days thereafter (that is on 2 7-8-2001) filed an appeal and chose not to pursue the application filed before the court which passed the consent decree. Such an appeal by the second defendant was not maintainable, having regard to the express bar contained in Section 96(3) of the Code.”

52. The next judgment is R. Rajanna v. S.R. Venkataswamy and Ors., (2014) 15 SCC 471 in which provisions of Order XXIII Rule 3 and Rule 3A were again considered. Afterextracting the aforesaid provisions, following was held by this Court in paragraph 11:-

“11. It is manifest from a plain reading of the above that in terms of the proviso to Order 2 3 Rule 3 where one party alleges and the other denies adjustment or satisfaction of any suit by a lawful agreement or compromise in writing and signed by the parties, the Court before whom such question is raised, shall decide the same. What is important is that in terms of Explanation to Order 2 3 Rule 3, the agreement or compromise shall not be deemed to be lawful within the meaning of the said Rule if the same is void or voidable under the Contract Act, 1872. It follows that in every case where the question arises whether or not there has been a lawful agreement or compromise in writing and signed by the parties, the question whether the agreement or compromise is lawful has to be determined by the court concerned. What is lawful will in turn depend upon whether the allegations suggest any infirmity in the compromise and the decree that would make the same void or voidable under the Contract Act. More importantly, Order 23 Rule 3-A clearly bars a suit to set aside a decree on the ground that the compromise on which the decree is based was not lawful. This implies that no sooner a question relating to lawfulness of the agreement or compromise is raised before the court that passed the decree on the basis of any such agreement or compromise, it is that court and that court alone who can examine and determine that question. The court cannot direct the parties to file a separate suit on the subject for no such suit will lie in view of the provisions of Order 23 Rule 3-A CPC. That is precisely what has happened in the case at hand. When the appellant filed OS No. 5326 of 2005 to challenge the validity of the compromise decree, the court before whom the suit came up rejected the plaint under Order 7 Rule 11 CPC on the application made by the respondents holding that such a suit was barred by the provisions of Order 2 3 Rule 3-A CPC. Having thus got the plaint rejected, the defendants (respondents herein) could hardly be heard to argue that the plaintiff (appellant herein) ought to pursue his remedy against the compromise decree in pursuance of OS No. 5326 of 2005 and if the plaint in the suit has been rejected to pursue his remedy against such rejection before a higher court.”

53. The judgments of Pushpa Devi (supra) as well as Banwari Lal (supra) were referred to and relied by this Court. This Court held that no sooner a question relating to lawfulness of the agreement or compromise is raised before the court that passed the decree on the basis of any such agreement or compromise, it is that court and that court alone who can examine and determine that question.

54. In subsequent judgment, Triloki Nath Singh v. Anirudh Singh (Dead) Through Legal Representatives and Ors., (2020) 6 SCC 629, this Court again referring to earlier judgments reiterated the same preposition, i.e., the only remedy available to a party to a consent decree to avoid such consent decree is to approach the court which recorded the compromise and separate suit is not maintainable. In paragraphs 17 and 18, following has been laid down:-

“17. By introducing the amendment to the Civil Procedure Code (Amendment) 1976 w.e.f. 1-2-1977, the legislature has brought into force Order 2 3 Rule 3-A, which creates bar to institute the suit to set aside a decree on the ground that the compromise on which decree is based was not lawful. The purpose of effecting a compromise between the parties is to put an end to the various disputes pending before the court of competent jurisdiction once and for all.

18. Finality of decisions is an underlying principle of all adjudicating forums. Thus, creation of further litigation should never be the basis of a compromise between the parties. Rule 3-A of Order 2 3 CPC put a specific bar that no suit shall lie to set aside a decree on the ground that the compromise on which the decree is based was not lawful. The scheme of Order 2 3 Rule 3 CPC is to avoid multiplicity of litigation and permit parties to amicably come to a settlement which is lawful, is in writing and a voluntary act on the part of the parties. The court can be instrumental in having an agreed compromise effected and finality attached to the same. The court should never be party to imposition of a compromise upon an unwilling party, still open to be questioned on an application under the proviso to Order 2 3 Rule 3 CPC before the court.”

55. The above judgments contain a clear ratio that a party to a consent decree based on a compromise to challenge the compromise decree on the ground that the decree was not lawful, i.e., it was void or voidable has to approach the same court, which recorded the compromise and a separate suit challenging the consent decree has been held to be not maintainable. In Suit No. 1101 of 1987, the plaintiff prayed for a declaration declaring that the decree passed in O.S. No. 37 of 1984 is sham and nominal, ultravires, collusive, unsustainable invalid, unenforceable and not binding on the plaintiffs. We have noted the grounds as contained in the plaint to challenge the consent decree in foregoing paragraphs from which it is clear that the compromise, which was recorded on 06.08.1984 was sought to be termed as not lawful, i.e., void or voidable. On the basis of grounds which have been taken by the plaintiff in Suit No.1101 of 1987, the only remedy available to the plaintiff was to approach the court in the same case and satisfy the court that compromise was not lawful. Rule 3A was specifically added by the amendment to bar separate suit to challenge the compromise decree which according to legislative intent to arrest the multiplicity of proceedings. We, thus, do not find any error in the judgment of trial court and High Court holding that Suit No. 1101 of 1987 was barred under Order XXIII Rule 3A.

56. We having found that Suit No. 1101 of 1987 being barred under Order XXIII Rule 3A, it is not necessary for us to enter into correctness or otherwise of the grounds taken in the plaint for questioning the compromise decree dated 06.08.1984. The compromise decree dated 06.08.1984, thus, could not have been questioned in Suit No. 1101 of 1987.

57. There remains one more submission which needs to be considered.

58. Learned counsel for the appellants contends that even if consent decree dated 06.08.1984 could not have been challenged, the appellants were entitled for shares in residential building at Tatabad, Dr. Alagappa Chettiar Road, Coimbatore, which was left out from the decree dated 06.08.1984. The above residential suit property was not a part in O.S. No.37 of 1984 and was not in compromise decree dated 06.08.1984. The averment of the appellant is that the said residential property was although in the name of defendant No.1 but it was acquired from joint family funds hence the appellant had also share in the property.

59. The residential building at Tatabad, Dr. Alagappa Chettiar Road, Coimbatore was included in Item No.10 of Schedule ‘B’ of properties to the following effect:

“Item No.X

In Coimbatore Registration on District, Coimbatore Corporation Limits, Tatabad, Dr. Alagappa Chettiar Road, D.No.101, Extent 0.33 acres with 4500 sq.ft. built up residential building.”

60. The above residential property was neither included in O.S.No.37 of 1984 nor part of compromise decree dated06.08.1984. The plaintiff’s prayer to declare the decree passed in O.S.37 of 1984 as unenforceable shall not preclude the consideration of a property which was not part of the decree. The appellants’ case for claiming share in the residential property at Tatabad, Alagappa Chettiar Road, Coimbatore, thus, needs to be considered in these appeals.

61. We may first notice pleadings regarding the case of the plaintiff and defendant No.1 with regard to above mentioned house property as reflected in O.S. No.1101 of 1987.

62. In paragraph 6(e) of the plaint, following has been pleaded by the plaintiff:

“6(e) In 1978 a palatial bungalow was purchased in Tatabad, Coimbatore. This is set out and described as Item No. 10 of Schedule ‘B’. The acquisition of this property was only out of the joint income and for the benefit of the family.”

63. Defendant Nos.1 to 3 filed written statements in O.S. No.1101 of 1987 and with regard to above averment made in paragraph 6(e), following has been pleaded by the defendant No.1:”6. The allegations in paragraph 6 of the plaint are not wholly true. The allegation that the property described as Item No.10 of Schedule ‘B’ was acquired out of the joint income for the benefit of the family is absolutely false. Firstly there was no joint income. Secondly there is no family, thirdly it was not purchased out of joint income. The property was taken in auction by the 1st defendant. The amount necessary for payment of the price was drawn by the 1st defendant from Swamy & Swamy Co. The amount was debited against him in the amounts of the Swamy & Co.”

64. The case of defendant No.1 was that above property was purchased in auction by the defendant No.1. The defendant No.1 had filed Ex.B-27 in support of his claim that house property is a separate property of defendant No.1. Ex.B-2 7 indicates that defendant No.1 was declared as the purchaser of the property as sold by public auction held on 28.11.1979 for Rs.1,51,000/-. Ex.B-27 was a sale certificate issued by Court of Subordinate Judge, Coimbatore to the above effect. Although in paragraph 6 of the written statement the defendant No.1 had pleaded that amount necessary for payment of price was drawn by defendant No.1 from Swamy and Swamy Co. Defendant No.1 appeared in Witness Box as DW-2 and stated in his cross-examination that he has for payment of house property at Tatabad utilised the funds of the Swamy and Swamy Plantations Co. In his cross-examination, he admitted that he had taken Rs. 1,50,000/-. In his cross-examination, following was stated by defendant No.2:

“It is incorrect to say that for purchasing house company funds were taken. I do not remember and there are no records to show from which partnership and from which account it was drawn. It is not correct to say that I took joint family funds and purchased. I would have taken about Rs.1.50 lakhs. It was not returned. Records cannot be produced now.”

65. In subsequent cross-examination, he clearly mentioned that the amount which was taken for the purchase of the house property at Tatabad was not returned to Swamy and Swamy Plantations Co. In his cross-examination on 12.08.1997, defendant No.2 states:

“On 12.8.1997 the witness was sworn and re-examined.

The reason for not returning the amount to Swamy & Sawmy Plantation Company from which it was borrowed for the purchase of the house in Tatabad, because there was credit balance in my name in the said company.”

66. Evidence on record, thus, indicates that Tatabad house property was purchased in the name of defendant No.1 and the consideration for purchase was paid from Swamy and Swamy Plantations Co. having its Directors and shareholders only the family members of all the branches. In his cross-examination defendant No.2 has stated:

“We started Co. by name Swamy and Swamy Plantations in 1974 in which members of all the three branches of the family were the shareholders.”

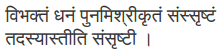

67. The details of the shareholders of the Swamy and Swamy Plantations (P) Ltd., Coonoor, were mentioned in O.S.No.37 of 1984 as Item No.10 of Schedule ‘C’ which is to the following effect:

“Item No.10

Details of shares in M/s. Swami and Swami Plantations (P) Ltd., Coonoor.

| S.No. | Name | No. of Shares | Total Value |

| 1. | S.K. Kumaraswamy | 920 | Rs.92,000.00 |

| 2. | S.K. Chinnasamy | 440 | Rs.44,000.00 |

| 3. | S.R.Shanmugavelautham | 410 | Rs.41,000.00 |

| 4. | S.R. Somasundaram | 230 | Rs.23,000.00 |

| 5. | Smt.R. Janaiammal | 810 | Rs. 1,000.00 |

| 6. | Smt. S. Saraswathy | 750 | Rs.75,000.00 |

| 7. | C.Kamalam | 610 | Rs.61,000.00 |

| 8. | Smt. C. Sathiyavathi | 75 | Rs. 7,500.00 |

| Total | 4245 | Rs.4,24,500.00″ |

68. As per details given above the Rangasamy branch held 2190 shares out of 4245 shares which is more than 50% shares of the Company.

69. The main plank of submission on behalf of respondent No.1 is that after the partition dated 07.11.1960, the three branches had separated and joint family status came to end. He submitted that partition dated 07.11.1960 is the registered partnership deed which partition was accepted by trial court in its judgment. The partition of joint family of three branches having been accepted on 07.11.1960 there was no joint family when the Tatabad house property was purchased in 1979.

70. The submission of the learned counsel for the appellants in support of the appeals is that partition dated 07.11.1960 was entered between three brothers to save the landed property from Land Ceiling Act. The partition deed dated 07.11.1960 was got registered on 07.11.1960, it claims that parties have divided immovable properties on 01.04.1960. The submission is that Land Ceiling Act was being implemented immediately after 01.04.1960 hence the said claim was set up in the partition deed. The partition deed was executed to save the landed property of the three branches and there was no intention of separating each branch and bringing the change in joint family status. The submission of Shri Giri has been reiterated which was also raised before the High Court that after partition dated 07.11.1960 the three brothers united and joint family continued even after 07.11.1960, which is evident from different properties purchased in the name of all the three branches, living together in ancestral house at Sadapalayam and newly constructed house at Somnur. After the purchase of land in 1963 all the three branches continued to run family businesses together.

71. Learned counsel for the appellants further submits that it is own case of defendant No.1 that partition agreement dated 08.03.1981 took between the parties under which Rangasamy branch agreed to take Vasudeva Textile Mills, the branch of defendant No.1, S.K. Kumarasamy decided to take property at Coonoor and Vedapathi villageand Chinnasamy branch decided to take property at Somnur. Defendant No.1 has pleaded that under the agreement dated 08.03.1981, the plaintiff had to pay Rs.7 lacs to defendant No.4 and defendant No.1 had to pay Rs.4 lacs to defendant No. 4 to equalise the valuation by partition as was agreed on 08.03.1981. Shri Giri submits that DW.1 himself came with case that partition had taken place on 08.03.1983 and compromise decree was nothing but implementation of the said agreement. Shri Giri submits that when defendant No.1 himself states about the partition in the year 1981, the partition pre-supposes the joint family and had the three branches separated from 07.11.1960, there was no question of again effecting partition in the year 1981.

72. One of the points for consideration before us is that as to whether at the time when Tatabad house was acquired by defendant No.1 whether all three branches were part of joint family or all the three branches after partition dated 07.11.1960 continued to be separate from each other.

73. The sheet anchor of the defendant No.1 is that three branches of family were not joint as it was partitioned by partition deed dated 07.11.1960. The partition deed dated 07.11.1960 is a registered partition deed between three branches. The partition deed dated 07.11.1960 referred to earlier partition deed dated 27.09.1953 by which the father of three brothers partitioned property between son of his first wife and his three sons from second wife. The properties which were allotted to in the partition deed dated 27.09.1953 was 86.72 acres between three brothers. The Partition Deed dated 07.11.1960 reads:-

“A Document dated 28.09.1953 bearing No.3158/1953 has been registered at the Coimbatore Registrar’s Office as a Partition Deed and has been executed on the 27th day of September, 1953 wherein the properties belonging to our brother Sennimalai Gounder, the son of the first wife of our father A.V. Kandasamy Gounder between us and our father. We have been enjoying the properties allotted to the three of us vide the said document as one family and have developed it, sold it, done agriculture in it and carried out business. We have also partitioned among us.

Since we decided to partition amongst ourselves we have divided the business capital belonging to our joint family vide accounts dated 1.4.1960. We have already divided the jewels, utensils and other articles and each of us are enjoying them separately. Though on 01.04.1960 we have divided the immovable properties such as house buildings, factory buildings, farm and lands to avoid litigation among us in future we have registered it through this document.”

74. The case of the appellant is that the partition deed dated 07.11.1960 was entered between three brothers to save the properties from land ceiling laws. The relevant date under the Land Ceiling Act was 07.04.1960 on which date the extent of properties in hands of a person has to be determined and since three brothers, who consisted members of joint family on the relevant date had more than the land which was permitted to a person, a partition was entered to save the properties from land ceiling laws. This argument was rejected by the trial court holding that it has not been proved that land ceiling laws in any manner affected the extent of land in the hands of three brothers. We need to notice some provisions of Tamil Nadu Land Reforms (Fixation of Ceiling on Land) Act, 1961. Section 3 of the Act which is a definition clause defines the word “person” in Section 3(34) which is to the following effect:-

“3(34). ”person” includes any company, family firm, society or association of individuals, whether incorporated or not or any private trust or public trust.”

75. Section 5 of the Act provide for ceiling area. According to sub-section (1)(a) of Section 5 the ceiling area in the case of every person and in the case of every family consisting of not more than five members was 30 standard acres. Figure of 30 standard acres was subsequently reduced to 15 standard acres by Tamil Nadu Act No. 37 of 1972. Section 5(1)(b) further provided that ceiling area in the case of every family consisting of more than five members shall be 30 standard acres together with an additional 5 standard acres for every member of the family in excess of five. In event, the ceiling area is determined treating the Hindu Undivided Family, joint family consisting of three brothers, the ceiling area shall be 30 standard acres by which 5 acres additional for every member of the family in excess of five. The land which was possessed by the three brothers in the year 1960 was more than 86.52 acres, which extent was received by the three brothers in 1953 partition. Thereafter three brothers have acquired further land. In case, three brothers before 07.04.1960 partition their joint family, then each person will be entitled to 30 acres. Thus, partition of the properties among three brothers was clearly beneficial to the properties possessed by the three brothers. The view of the trial court that it is not proved that any benefit under the Ceiling of Land Act could have been obtained by three brothers is clearly untenable. The view expressed by the trial court was not after examining the provisions of Act, 1961. Further the statement in the partition that three brothers have already divided the immovable properties on 01.04.1960 clearly was with intent to get away from Act, 1961 since the relevant date under the Ceiling Act was 07.04.1960.

76. Under Hindu Law, any member of the joint family can separate himself from joint family. The intention of the parties to terminate the status of joint family is a relevant factor to determine the status of Hindu Undivided Family. From the above, it is clear that real intendment of three branches to partition their properties was not that they did not want Hindu Undivided Family to continue rather the said partition was with object to get away from application of Ceiling Act, 1961. The intention of the parties when they partitioned their properties in the year 1960 is a relevant fact.

77. However, the Partition Deed dated 07.11.1960 being a registered Partition Deed between three branches, the same cannot be ignored. Properties admittedly were divided in three branches by the said partition. The question is as to whether after 07.11.1960, the family continued as a Joint Family or the status of joint family came to an end on 07.11.1960. The case of the appellant which was also pressed by the High Court was that even if partition dated 07.11.1960 is accepted; the parties lived in a joint family and continued their joint family status. The contention advanced by the appellant was that there was reunion between three brothers to revert to the status of Joint Hindu Family, which is amply proved from the acts and conducts of the parties subsequent to 07.11.1960.

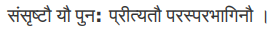

78. The concept of reunion in Hindu Law is well known. Hindu Joint Family even if partitioned can revert back and reunite to continue the status of joint family. Mulla on Hindu Law, 22nd Edition, while deliberating on reunion has status following in paragraphs 341, 342 and 343:-

“341. Who may reunite,- ‘A reunion in estate properly so called, can only take place between persons who were parties to the original partition’. It would appear from this that a reunion can take place between any persons who were parties to the original partition. Only males can reunite.

342. Effect of reunion,- The effect of a reunion is to remit the reunited members to their former status as members of a joint Hindu family.

343. Intention necessary to constitute reunion: To constitute a reunion, there must be an intention of the parties to reunite in estate and interest. In Bhagwan Dayal v. Reoti Devi, the Supreme Court pointed out that it is implicit in the concept of a reunion that there shall be an agreement between the parties to reunite in estate with an intention to revert to their former status. Such an agreement may be express or may be implied by the conduct of the parties. The conduct must be of an incontrovertible character and the burden lies heavily on the party who assets reunion.”

79. The Privy Council in Palani Ammal v. Muthuvenkatacharla Moniagar and Ors., AIR 1925 PC 49 has held that if a joint Hindu family separates, the family or any members of it may agree to reunite as a joint Hindu family, but such a reuniting is for obvious reasons, which would apply in many cases under the law of the Mitakshara, of very rare occurrence, and when it happens it must be strictly proved as any other disputed fact is proved. In paragraph 9, the Privy Council laid down following :-

“9. But the mere fact that the shares of the coparceners have been ascertained does not by itself necessarily lead to an inference that the family had separated. There may be reasons other than a contemplated immediate separation for ascertaining what the shares of the coparceners on a separation would be. It is also now beyond doubt that a member of such a joint family can separate himself from the other members of the joint family and is on separation entitled to have his share in the property of the joint family ascertained and partitioned off for him, and that the remaining coparceners, without any special agreement amongst themselves, may continue to be coparceners and to enjoy as members of a joint family what remained after such a partition of the family property. That the remaining members continued to be joint may, if disputed, be inferred from the way in which their family business was carried on after their previous coparcener had separated from them. It is also quite clear that if a joint Hindu family separates, the family or any members of it may agree to reunite as a joint Hindu family, but such a reuniting is for obvious reasons, which would apply in many cases under the law of the Mitakshara, of very rare occurrence, and when it happens it must be strictly proved as any other disputed fact is proved. The leading authority for that last proposition is Balabux Ladhuram v. Rukhmabai (1903) 30 Cal. 725.”

80. Another judgment which needs to be noticed is judgment of Madras High Court in Mukku Venkataramayya v. Mukku Tatayya and Ors., AIR 1943 Mad. 538. In the above case, there was partition in the family in the year 1903 as a result of which the father with his second wife and children separated and begin to live apart from his sons by the first wife. The case of the respondent was that he and his brothers continued to remain joint after their father decided to remain away from them in 1903. An alternative case was also put forward that there has been a reunion amongst the brothers after the partition. Madras High Court in paragraph 5 stated:-

“5………………………But if a general partition between all the members takes place, reunion is the only means by which the joint status can be re-established. Mere jointness in residence, food or worship or a mere trading together cannot bring about the conversion of the divided status into a joint one with all the usual incidents of jointness in estate and interest unless an intention to become re-united in the sense of the Hindu law is clearly established. The rule is, if I may say so with respect, correctly stated by the Patna High Court, in Pan Kuer v. Ram Narain Chowdhary, A.I.R. 1929 Pat. 353 where the learned Judge observes that:

To establish it, (reunion), it is necessary to show not only that the parties already divided, lived or traded together, but that they did so with the intention of thereby altering their status and of forming a joint estate with all its usual incidents.

81. The High Court held that the brothers, who had divided, lived and traded together, the case of the reunion was accepted. In paragraph 17, following was laid down:-

“17. The question then is, whether this finding is sufficient to support a case of reunion. We are conscious that the burden of proof is heavily on the respondent and also that proof of mere jointness in residence, food and worship does not necessarily make out reunion. What is to be established is that not only did the parties who had divided lived and traded together, but that they did so with the intention of thereby altering their divided status into a joint status with all the usual incidents of jointness in estate and interest. In our opinion the way in which the brothers dealt with each other leaves no room for doubt that it was their deliberate intention to reunite so as to reproduce the joint status which had existed before the partition of 1903. The immediate object of the partition was to enable the father to live separately from his sons by the first wife, as misunderstandings had arisen between them. As between the sons themselves there never was any reason for a separation inter se and there can be no doubt that the moment they separated away from their father they desired to live and lived together in joint status. It is true that at that time the first respondent was a minor. But this can make little difference if after he attained majority he accepted the position in which the appellant and Nagayya had already begun to live together. In our view it is not necessary that there should be a formal and express agreement to reunite. Such an agreement can be established by clear evidence of conduct incapable of explanation on any other footing. Such, in our view, is the position here established. That being so, the claim of the appellant to the exclusive ownership of the properties in suit must be negatived. The appeal fails and must therefore be dismissed with costs.”

82. One more judgment on the concept of reunion which need to be referred to is the judgment of Karnataka High Court is M/s. Paramanand L. Bajaj, Bangalore v. The Commissioner of Income Tax, Karnataka, II, Bangalore, (1981) SCC Online Karnataka 131. Justice Rama Jois after referring to Smritis and relevant judgments on the subject laid down that reunion is the reversal of the process of partition, following was held in paragraphs 8 and 12:-

“8. The basic proposition of Hindu Law on reunion is laid down in Brihaspati Smriti (Gaekwad’s Oriental Series, Vol. LXXXV-pp 214-215), also vide Smrti-Chandrika III Vyavaharakanda Part II (1916) published by Government of highness the Maharaja of Mysore pp 702-703; English version J.R. Gharpura (1952) Part III pp 667-670).

He who being once separated dwells again through affection with his father brought or paternal uncle is termed reunited.

When two coparceners have again become reunited through affection, they shall mutually participate in each others properties.

The view expressed by Devanna Bhatta, the author of Smriti-Chandrika on the text of Brihaspati is-

Association not necessarily being by co-residence, the association is expressed to be through wealth; so by way of removing the distinguishing factor of that, it should be understood that the re-association of the separated members shall be to the extent of pooling together(all) the wealth etc., as before, and not merely by a co-residence only.

Mitakshra on Yaj.II 138-139, which lay down special rule of inheritance at a partition among reunited members explains the effect of reunion as follows:

Effects which had been divided and which are again mixed together are termed re-united. He, to whom such appertain, is a re-united parcener.

The aforesaid provisions have been the subject matter of interpretation in number of cases.